Key Competencies Kit

for Facing Lifelong Learning

|

This Project has been funded with support from the European Commission. This communication reflects the views only of the author, and the Commission can not be held responsible for any use which may be made of the information contained therein. |

|

Didactic Unit 5 |

Theme |

Time |

Risk management |

|

2 hours |

|

||

|

There are many definitions of risk that vary in different circumstances and situations. Just as you cannot solve a problem without identifying one, you cannot manage risks without identifying them.

While some definitions of risk focus only on the probability of an event occurring, more comprehensive definitions incorporate both the probability of the event occurring and the consequences of the event. Thus, the probability of a severe earthquake may be very small but the consequences are so catastrophic that it would be categorized as a high-risk event.

What is risk? Risk is part of our everyday life. From the moment we get up in the morning, drive or take public transportation to get to work until we get back into our beds we are exposed to different risks.

While some of the risks may seem not very serious, others make a significant difference in the way we live our lives.

Risk is a driving force of progress because every major innovation is possible because someone took a risk and challenged the existing order.

Risk may provide opportunities while exposing us to outcomes that we may not desire. It is the balancing of risk and reward that lies at the core of the risk definition.

hat makes management of risk challenging is that while some of this risk that we face does not depend on us (becoming unemployed because enterprise you work for fall bankrupt, for example), we seek out some risks on our own (starting new business versus continue to work as hired worker, or gambling, for instance).

This Chinese symbol for risk is a combination of danger (crisis) and opportunity,

|

Those who seek large rewards often to expose themselves to considerable risk. The link between risk and return is most noticeable in any business.

A business risk is a circumstance or factor that may have a negative impact on the operation or profitability of a given company.

Not surprisingly, therefore, the decisions on how much risk to take and what type of risks to take are critical to the success of a business.

A business that decides to protect itself against all risks is unlikely to generate much benefit for its owners, but a business that exposes itself to high risks may be devastating.

The essence of good risk management is making the right choices when it comes to dealing with different risks.

Risk management involves assessing and quantifying business risks, then taking measures to control or reduce them.

Most often risk management focuses on risk reduction, with little or no attention paid to exploiting risk.

ood risk management allows businesses choose through the myriad of risks that they face, which risks they should ignore, which risks they should reduce or eliminate and which risks they should actively seek out and exploit.

|

If you plan to successfully manage risks, repeat these two words “what if…” each time you think of taking a decision that may cause changes in current situation. You cannot afford to live without them when undertaking the risk identification exercise. Cultivate an important habit of asking - “What if” to every decision or step. |

In simple terms risk assessment in business is simply a careful examination of what could damage the business, so that you can weigh up whether you have taken enough precautions or should do more to mitigate or prevent possible harm.

Do not overcomplicate the process of risk assessment. Often in small business many risks are well known. If you run a small business and you are confident you understand what’s involved, you can do the assessment yourself. You don’t have to be a risk management expert.

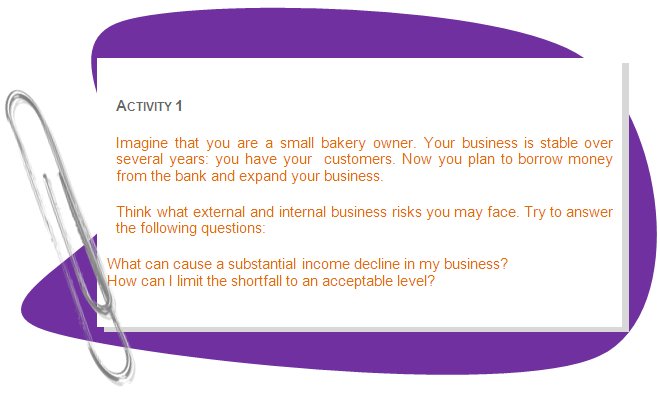

There are two types of risk to consider. External risks are factors outside of the business over which you have little or no control (inflation, high taxation; growth in electricity prices; economic downturn).

Internal risks are inside the business and include such things as, for example, debt; loss of skilled workers...

For example, you run a small bakery and have customers that live nearby and buy your product. Close to your place a supermarket may be opened and you are afraid that you can loose part of your customers. To eliminate this risk you may chose many actions. For example, move to another place, reduce price, negotiate with supermarket owners and try to persuade them to buy all bread from you. |

To assess risk you may should follow the following steps:

|

Answers to the questions and exercises of Didactic Unit 5 |

1.

2.